The income tax 26AS form is a tax credit statement. This is an important document where tax filing is concerned.

What Does Form 26 AS Cover?

The form contains all the information related to the details of tax collected by collectors, an advance tax paid by you, self-assessment tax paid, assessed tax deposited by you, and refund details that have been received.

Form 26AS (Annual Statement)

Form 26AS is an annual statement that contains details related to:

- Tax Deducted at Source (TDS)

- Information about refunds you received during a fiscal year

- Information about taxes collected by your collectors

- Tax Paid in Advance

- Self Assessment Tax Payment

- Regular assessment tax from what you have deposited

- Information relating to high-value transactions relating to shares, mutual funds, etc.

Importance of Tax Credits Form 26 AS

The reasons that Form 26AS is relevant are given below:

- You will be able to check whether the deductor has filled the TDS details correctly or whether the tax collector has correctly filled the details of Tax Collected at Source (TCS)

- With it, you can verify whether the tax deducted and collected on your behalf has been deposited in the Government Treasury

- You can check tax credit and income tax calculation before filing ITR

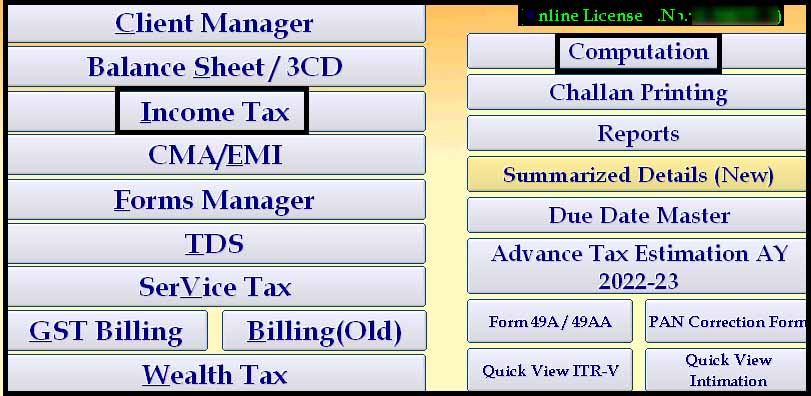

Download Form 26AS by Gen Income Tax E-filing Software with Step by Step

Now you can import and download Form 26AS by Gen ITR Filing Software in the most convenient way.

Step1: Open the Gen Income Tax software

Step2: Navigate to income tax > Computation > Select the client

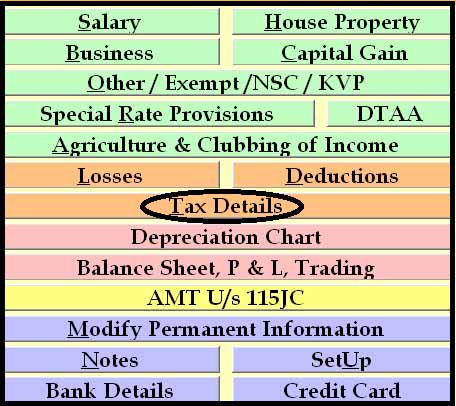

Step3: Now click on Tax Details

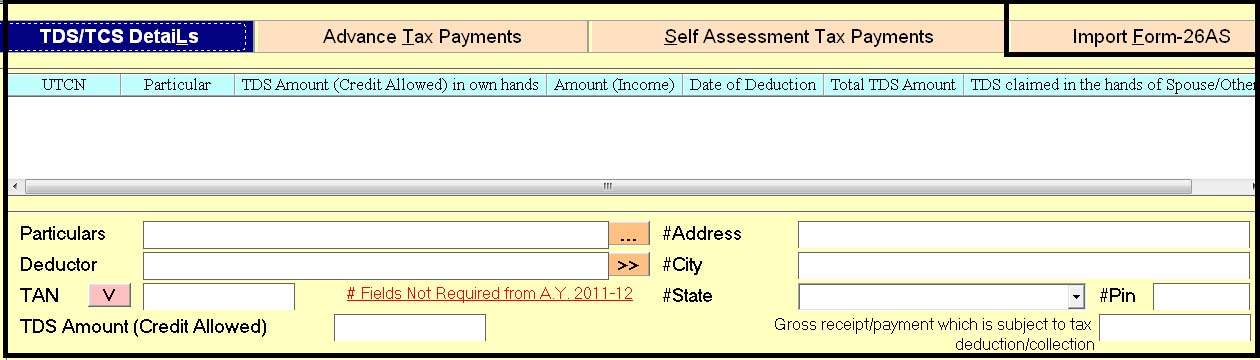

Step4: Then click on import from 26AS tab to Import

Step4: Then click on import from 26AS tab to Import

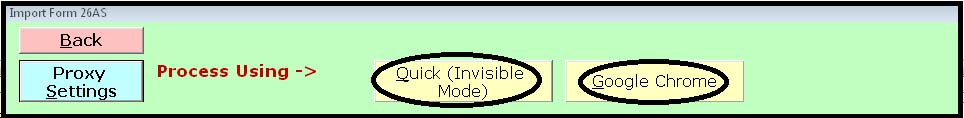

Step5: You can select either quick invisible mode or google chrome

Step5: You can select either quick invisible mode or google chrome

View & Download Form 26AS on New ITR Filing 2.0 Portal

- Visit the official website: https://www.incometax.gov.in/iec/foportal/

- Login to the new ITR E-filing Portal 2.0

- Now navigate to the ‘My Account’ menu, then click the ‘View Form 26AS (Tax Credit)’ URL.

- Take a look at the disclaimer, click ‘Confirm’ & you will be redirected to the government TDS-CPC official Portal.

- In the TDS-CPC government portal, Agree with the acceptance of usage. Click to ‘Proceed’.

- Click on ‘View Tax Credit (Form 26AS)’

- Choose the AY (Assessment Year) & ‘View type’ (HTML, Text or PDF)

- Click to ‘Download and View’ in PDF format.

Reasons to Purchase Gen Income Tax Software

Gen income tax software has become the first choice of Chartered Accountants as it calculates Self Assessment and Advance Tax and calculates interest as per sections 234A, 234B, and 234C. It has many attractive features like Auto Return Form, XML Generation, PAN Application, Array Relief Calculation, 26AS Import, PAN Application, Corrections, etc.

So visit the SAG Infotech website and fill the query form to try the free trial of Gen ITR e-filing software, with this software you can easily view and import the 26AS (Tax Credit) form.

General Queries on Form 26AS (Tax Credit Statement)

In Part A1 of this form, you will have information about your income where TDS has not been deducted while you have submitted Form 15G/Form 15H.

Why does Form 26AS deserve attention?

This form is an annual credit statement (consolidated) issued in respect of your PAN. It is important that you compare Form 16 with Form 26AS that you have received from your employer.

What are the steps to be taken if advance tax has been paid in the bank account; but, this is not reflected in Part C of Form 26AS?

This problem appeared because the bank has made an error in its data entry. So a person has to take up the issue with the person’s bank and rectify the amount.

Can a person amend the name and address (mentioned in PAN) in Form 26AS?

Yes, if the PAN holder’s given details are incorrect, he/she can. An individual is required to submit an application through the ‘Request for new PAN card or/and change or correction in PAN data option’ on the official website of the tax department.